The Educational Choice for Children Act (ECCA) is a federal proposal (H.R. 833 & S 292) to provide $10 billion annually in scholarships to students. It is an important step in the effort to bring universal school choice to every state.

TAKE ACTION TODAY!

Ask your members of Congress to support the “Educational Choice for Children Act” (ECCA – H.R. 833 / S 292)

USCCB Action Alert, which includes a prefixed message to your federal officials is HERE.

The bill will:

- Encourage taxpayers to invest in education

- Cover a variety of education expenses including tuition, tutoring, and special ed services.

- Provide a dollar-to-dollar federal tax credit to those who donate to a nonprofit scholarship granting organization (SGO)

- Help public, private, and homeschooled students in every state.

Congress is considering a $10 billion school choice proposal and we need you to urge your representatives to support this bill. The bill has gathered momentum in Congress and is the fastest and surest way to bring school choice to all 50 states.

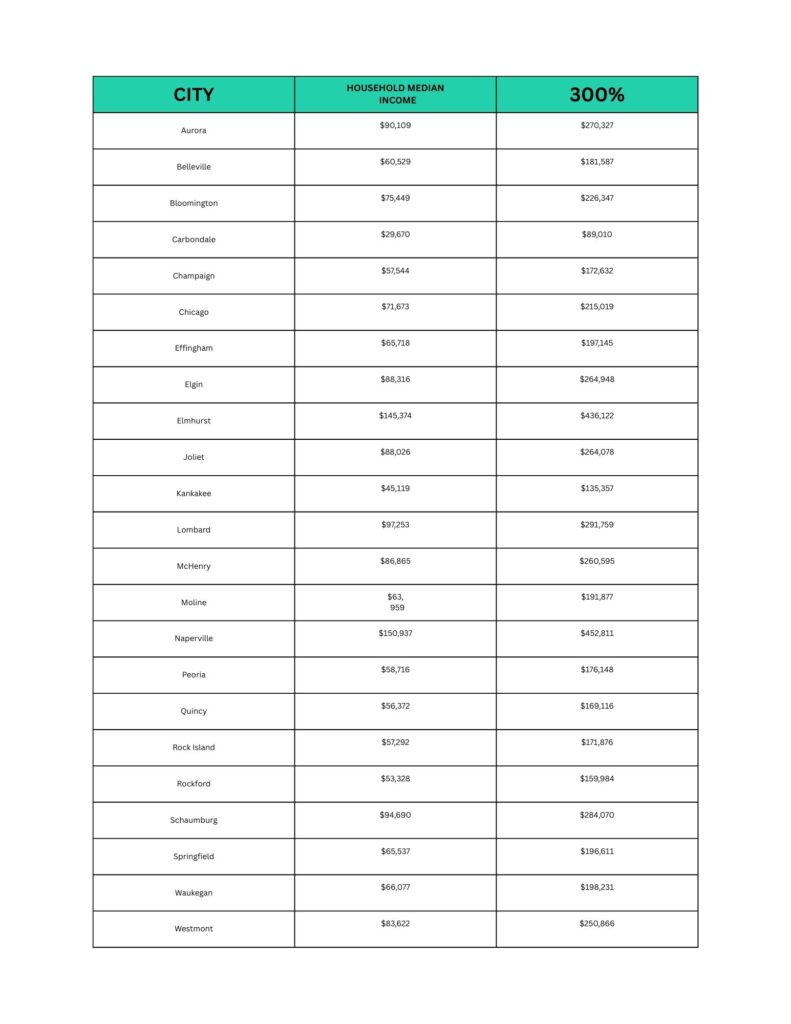

The Educational Choice for Children Act (ECCA) will encourage taxpayers to invest in education and cover expenses facing public and private school children. It does this by allowing, within a specified framework, a dollar-for-dollar federal tax credit for taxpayers (up to 10% of an individuals adjusted gross income) who contribute to Scholarship Granting Organizations (SGO). These SGO’s would then provide scholarships to children of eligible families for a range of educational expenses, including private school tuition! Eligibility is for families earning 300% or below of the median income in that area.

SUMMARY

WHO: Eligible students from families with a household income at of below 300% of the area’s median gross income, as determined by established guidelines.

WHAT: $10 billion in annual scholarships can be applied toward private school tuition, special education services, and various other educational expenses.

WHERE: All 50 states

HOW: Congress needs to pass HR 833 or S 292. Funds are then generated by generous donors who receive a dollar-for-dollar federal tax credit for contributions to nonprofit scholarship organizations.

COMMON QUESTIONS

WHO IS ELIGIBLE? Eligibility for ECCA extends to students in families that are earning 300% or below of the median income in that area. Priority will be given to previous scholarship students and their siblings.

WHAT ARE EXAMPLES OF ALLOWABLE USES OF A SCHOLARSHIP? Tuition, curriculum, books, online educational materials, tutoring, educational therapies for students with disabilities including; occupational, physical, behavior, speech-language therapies.

WHAT IS THE MAXIMUM SCHOLARSHIP AMOUNT? The maximum scholarship amount awarded is determined by each scholarship granting organization.

HOW DO I APPLY FOR A SCHOLARSHIP? Once the bill becomes law, families will be able to apply directly to an approved scholarship granting organization.

HOW MUCH FUNDING DOES EACH STATE RECEIVE? Every state will be assigned a minimum amount of tax credits, and anything above that amount will be distributed on a first come, first serve basis.

HOW IS FIRST COME, FIRST SERVE DETERMINED? The Treasury Department will create a website portal that will track the remaining tax credits in real time and adjust the remaining total every time a donation is made to an SGO.

IS THERE A DEADLINE TO CONTRIBUTE? Donors will have to c9ontribute by December 31 each year or whenever the tax credits are used up, which could happen earlier.

CAN I EARMARK MY DONATION TO A SPECIFIC SCHOOL? A SGO can choose to allow donors to earmark their contributions to a specific school or group of schools.

CAN I DONATE TO A SGO IN A DIFFERENT STATE? Yes. Donors can choose to donate to any qualified SGO in any state. ECCA is a federal program and states do not have to opt in.

DONOR INFORMATION

DO I GET A TAX CREDIT FOR THE AMOUNT I SPEND ON MY CHILD’S TUITION? No. The ta credit is for donations to the SGO, not tuition paid to a school. The donor receives a tax credit whether or not he or she even has a child.

WHAT IS THE MAXIMUM I CAN DONATE AND STILL GET A TAX CREDIT? The max credit for an individual is 10% of adjusted gross income (line 11 on your 1040) or $5,000, whichever is higher. If you have $100,000 or more of AGI and donate $10,000 you can receive a $10,000 credit on your federal taxes.

WHAT IF MY TAX LIABILITY IS LESS THAN THE AMOUNT I DONATED? The tax credit can be carried forward up to 5 tax years.

CAN I EARMARK MY DONATION TO A SPECIFIC CHILD? No.